2019

Notice of Annual Meeting of Shareholders

December 17, 2019

4:00 p.m. Central Time

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

| | | | |

| | | SCHEDULE 14A | | |

| | | | | |

| Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 |

Filed by the Registrant x

Filed by party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to sectionSection 240.14a-12

|

| | |

| | WINNEBAGO INDUSTRIES, INC. | |

| | (Name of Registrant as Specified in Its Charter) | |

| | | |

| | (Name of Person(s) Filing Proxy Statement, if Other than the Registrant) | |

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |

| 1) | Title of each class of securities to which transaction applies: |

| |

| 2) | Aggregate number of securities to which transaction applies: |

| |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| 4) | Proposed maximum aggregate value of transaction: |

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and

the date of its filing.

| |

| 1) | Amount previously paid: |

| |

| 2) | Form, Schedule or Registration Statement No.: |

Notice of Annual Meeting

of Shareholders

to be held December 13, 201617, 2019

To the

Dear Fellow Shareholders, of

Winnebago Industries, Inc.

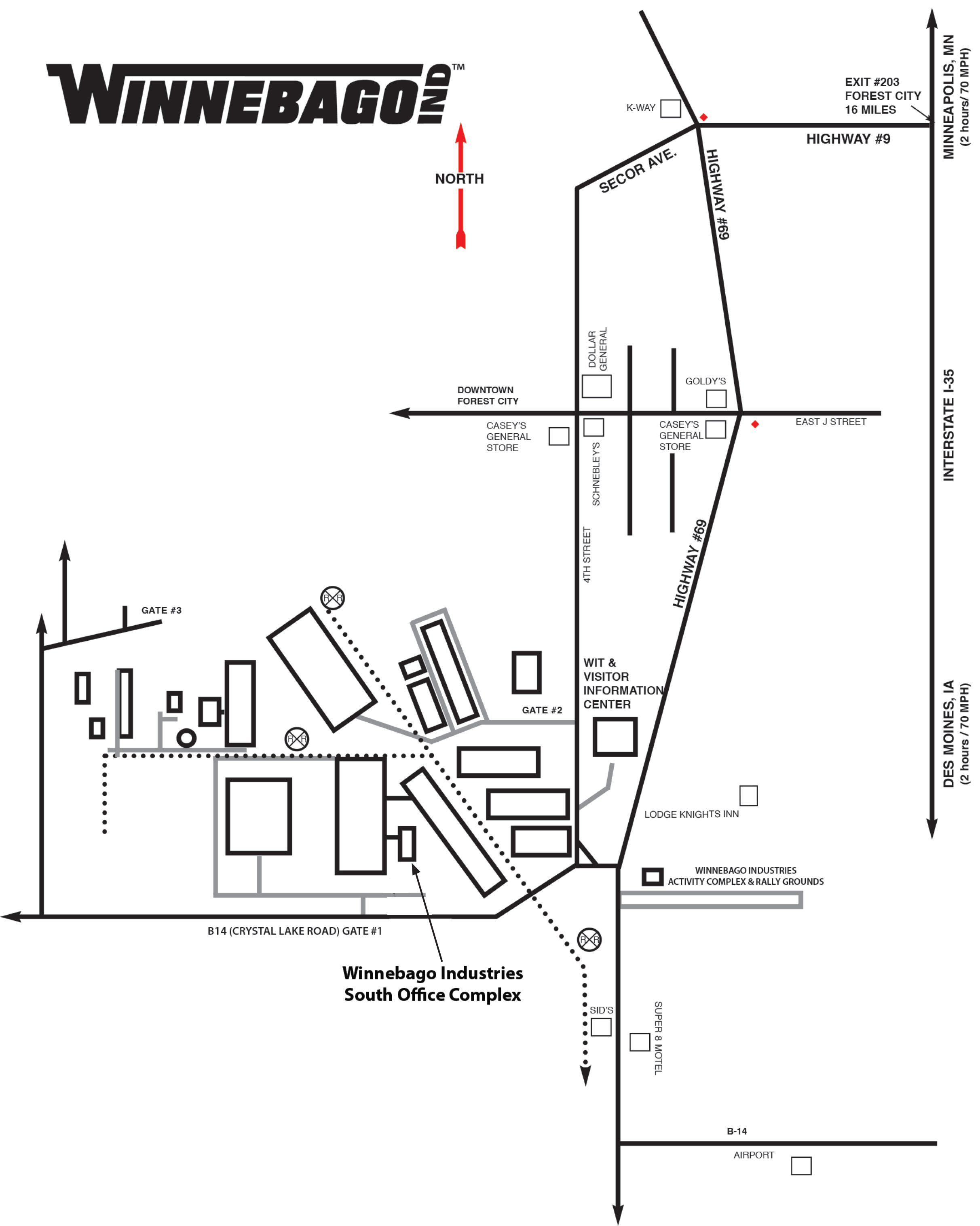

The will hold its 2019 Annual Meeting of Shareholders of Winnebago Industries, Inc. will be held on Tuesday, December 13, 2016,17, 2019, at 4:00 p.m., Central Standard Time,Time. The Annual Meeting will be completely virtual. You may attend the meeting, submit questions, and vote your shares electronically during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/WGO2019 and entering the 16-digit control number included with the Notice of Internet Availability or proxy card. Instructions on how to attend and participate in Winnebago Industries' South Office Complex Theater, 605 West Crystal Lake Road, Forest City, Iowa, for the following purposes:Annual Meeting via the webcast are posted on this site as well.

The proxy materials were either made available to you over the Internet or mailed to you on or about November 5, 2019. At the meeting, shareholders will be asked to:

|

| | | | |

1. | to elect one Class III director to serve the remainder of the

| | BOARD RECOMMENDATIONS | |

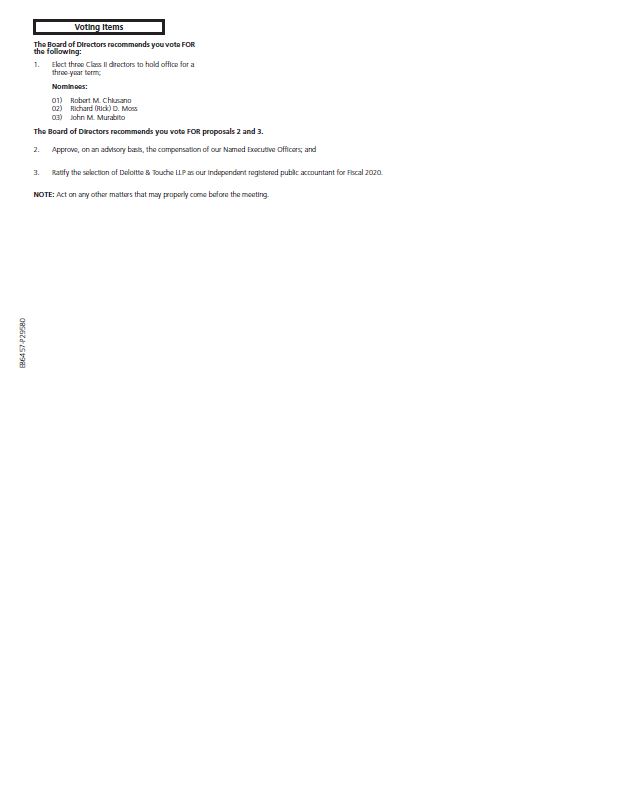

| 1 | Elect three year term and to elect one Class II director directors to hold office for a three-year term; |

| FOR | |

2. | to provide advisory approval of executive compensation; |

| |

3. | to ratify2 | Approve, on an advisory basis, the appointmentcompensation of our Named Executive Officers; | FOR | |

|

| 3 | Ratify the selection of Deloitte & Touche LLP as our independent registered public accountant for the fiscal year ending August 26, 2017;Fiscal 2020; and |

| FOR | |

4. |

| to transact such | Act on any other business asmatters that may properly come before the meeting or any adjournment or adjournments thereof.meeting. | | |

|

The Board

Only shareholders of Directors of the Company has fixedrecord at the close of business on October 10, 2016, as the record date for the determination of shareholders entitled to notice of and to22, 2019 may vote at this meeting and atthe Annual Meeting or any and all adjournmentsadjournment thereof.

|

| | | |

| | | By Order of the Board of Directors | |

| | | | |

| | | /s/ Scott C. FolkersStacy L. Bogart | |

| | | Scott C. FolkersStacy L. Bogart | |

| | | Vice President - General Counsel | |

| Eden Prairie, MN | | and Secretary | |

Forest City, Iowa | | | |

October 19, 2016November 5, 2019 | | | |

Your Vote Is Important

Whether or not you expect to attend the meeting, in person, please vote via the Internet or telephone or request a paper proxy card to complete, sign and return by mail so that your shares may be voted. A prompt response is helpful and your cooperation is appreciated.

|

| |

TABLE OF CONTENTSTable of Contents |

| Page |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| 36 |

| |

| |

| |

| |

| |

| |

| |

| |

WINNEBAGO INDUSTRIES, INC.Winnebago Industries, Inc.

605 West Crystal Lake Road - Forest City, Iowa 50436

FORWARD-LOOKING INFORMATION

Forward-looking Information

Statements in this Proxy Statement not based on historical facts are considered “forward-looking” and, accordingly, involve risks and uncertainties that could cause actual results to differ materially from those discussed. Although such forward-looking statements have been made in good faith and are based on reasonable assumptions, there is no assurance that the expected results will be achieved. These statements include (without limitation) statements as to future expectations, beliefs, plans, strategies, objectives, events, conditions and financial performance.

These statements are intended to constitute “forward-looking” statements in connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Winnebago Industries, Inc., an Iowa corporation (the “Company,” “Winnebago Industries,” “we,” “us” and “our”), is providing this cautionary statement to disclose that there are important factors that could cause actual results to differ materially from those anticipated. Reference is made to our Annual Report on Form 10-K for the fiscal year ended August 27, 201631, 2019 (the “2016“2019 Form 10-K”) filed with the Securities and Exchange Commission (the “SEC”) for a list of such factors.

PROXY STATEMENT

Proxy Statement

This Proxy Statement is furnished in connection with the solicitation by our Board of Directors of proxies to be used at the Annual Meeting of Shareholders to be held in our South Office Complex Theater, 605 West Crystal Lake Road, Forest City, Iowavirtually on December 13, 2016,17, 2019, at 4:00 p.m., Central Standard Time, and at any and all adjournments thereof (the “Annual Meeting” or the “Meeting”).

In accordance with rules and regulations adopted by the SEC, instead of mailing a printed copy of our proxy materials to each shareholder of record, we are now furnishing proxy materials to our shareholders on the Internet. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials, unless you specifically request a printed copy. Instead, the Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review all of the important information contained in the proxy materials.

The Notice of Internet Availability of Proxy Materials also instructs you as to how you may submit your proxy on the Internet. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials.

It is anticipated that the Notice of Internet Availability of Proxy Materials will be mailed to shareholders on or about October 19, 2016.November 5, 2019.

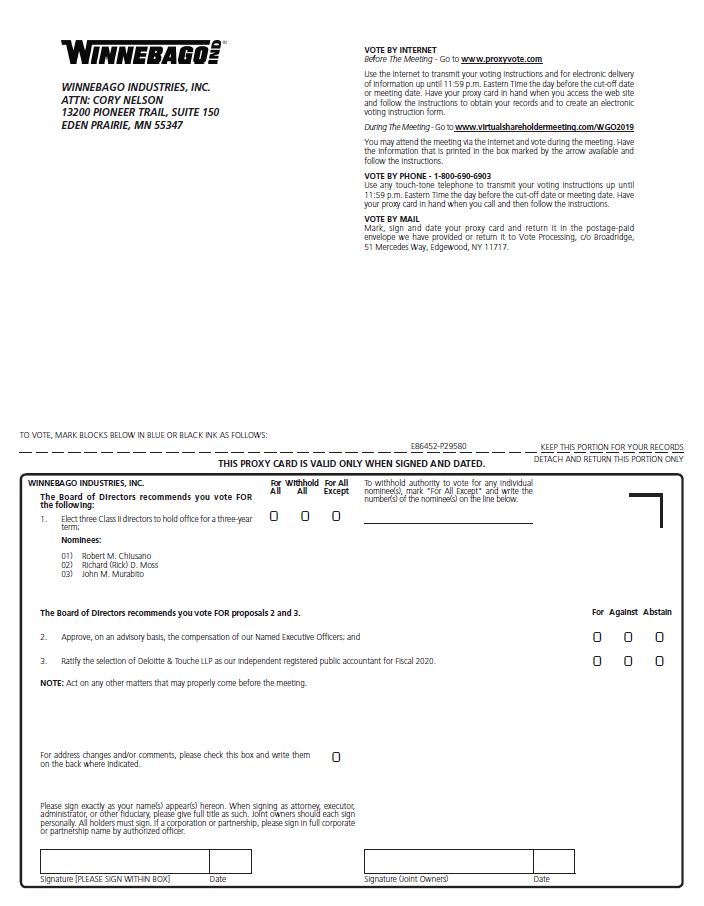

Only holders of record of our common stock, par value $0.50 per share ("Common Stock of recordStock"), at the close of business on October 10, 201622, 2019 (the "Record Date") will be entitled to Noticereceive notice of Internet Availability of Proxy Materials and to vote at the Annual Meeting. At such date,On the Record Date, we had outstanding 27,189,02731,684,985 shares of Common Stock par value $.50 per share (“Common Stock”)

that were eligible to vote. Each share of Common Stock entitles the holder to one vote uponon each matter to be voted upon at the meeting. A majority of the outstanding shares of Common Stock represented in person or by proxy will constitute a quorum for the Annual Meeting.

If you have returned your properly signedsubmit a proxy or attend the Meeting, in person, your Common Stock will be counted for the purpose of determining whether there is a quorum.

If you hold shares in your own name, by submitting a proxy you may either vote for or withhold authority to vote for each nominee for the Board of Directors, you may vote in favor or against or abstain from the ratification of the appointment of independent registered public accountant, and you may vote in favor or against or abstain from the approval on an advisory basis of the executive compensation disclosed in this Proxy Statement. If you sign and submit your proxy card without voting instructions, your shares will be voted in favor of each director and each other item considered for shareholder approval. If you hold shares through a broker, follow the voting instructions provided by your broker. If you want to voteShares held in person, a legal proxy must be obtained from your broker and brought to the Meeting. The New York Stock Exchange (“NYSE”) permits brokers to vote their customers' shares on routine matters when the brokers have not received voting instructions from their customers. The ratification of the appointment of independent registered public accountant is an example of a routine matter on which brokers may vote in this way. Brokers may not vote their customers' shares on non-routine matters suchname as shareholder proposals unless they have received voting instructions from their customers. Under NYSE rules, brokers are also not permitted to exercise discretionary voting authority with respect to shares for which voting instructions have not been received, as such voting authority pertains to the election of directors (whether contested or uncontested) and to matters relating to executive compensation. As a result of the NYSE rules, unless they have received voting instructions from their customers, brokers may not vote their customers' shares on any other matters other than ratification of our independent registered public accountant.

Directors must be elected by a plurality of the votes cast at the Meeting. This means that if there is a quorum, the nominee in each class receiving the greatest number of votes will be elected as directors. Votes withheld from any nominee will still be counted for the purposes of establishing a quorum but will have no legal effect on the election of directors due to the fact that such elections are by a plurality of the votes cast. The ratification of the appointment of the independent registered public accountant requires the affirmative vote of a majority of those shares of Common Stock present in person or represented by proxy. Withheld votes and abstentions with respect to this Item will have the same effect as a vote against the matter.

In addition, while the Board of Directors intends to carefully consider the shareholder votes resulting fromof record may be voted electronically during the Annual Meeting.

The table below summarizes the vote required to approve each proposal, under Item (2): Proposal For an Advisory Votethe voting options for each proposal and other important information regarding voting on Executive Compensation (the "Say on Pay" Vote), the final vote ofeach proposal:

|

| | | | |

| Vote Required | Voting Options(1) | Board Recommend-ation(2) | Broker Discretionary Voting Allowed(3) |

Item 1: Elect three Class II directors to hold office for a three-year term | Plurality of the votes cast(4) | FOR WITHHOLD | FOR | No |

Item 2: Advisory approval of executive compensation (the "Say on Pay" vote) | Majority of the votes cast(5) | FOR AGAINST ABSTAIN | FOR | No |

Item 3: Ratify the appointment of Deloitte & Touche LLP as our independent registered public accountant for the fiscal year ending August 29, 2020 | Majority of the votes cast | FOR AGAINST ABSTAIN | FOR | Yes |

| |

| (1) | A withhold vote or abstention will have no impact on the outcome of the voting on any of the proposals. |

| |

| (2) | If you submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board's recommendations set forth above. |

| |

| (3) | If broker discretionary voting is not allowed, your broker will not be able to vote your shares on these matters unless your broker receives voting instructions from you. A broker non-vote will have no effect on the outcome of the voting on any of the proposals. |

| |

| (4) | The Board of Directors has adopted a majority voting policy for the election of directors in uncontested elections. Under this policy, in any uncontested election of directors of the Company, if any nominee receives less than a majority of the votes cast for the nominee, that nominee shall still be elected, but must tender their resignation to the full Board of Directors for consideration at the next regularly scheduled meeting of the Board of Directors. The Board of Directors shall only not accept the tendered resignation for, in their judgment, a compelling reason. |

| |

| (5) | The vote of shareholders on this proposal is not binding on the Company, but rather is advisory in nature; however, the Board of Directors intends to carefully consider the result of the vote on this proposal. |

shareholders will not be binding on the Company, but will be advisory in nature.

We are not aware of any matters to be presented at the Annual Meeting other than the election of the two nominees described in this Proxy Statement, the advisory approval of executive compensation, and the ratification of the appointment of independent registered public accountant. If any matters not described in this Proxy Statement are properly presented at the Meeting, the proxies will use their personal judgment to determine how to vote your shares. If the Meeting is adjourned, the proxies can vote your Common Stock on the new Meeting date as well, unless you have revoked your proxy instructions.

Before the Meeting, you can appoint a proxy to vote your shares of Common Stock by following the instructions as set forth in the Notice of Internet Availability of Proxy Materials. If, by request, you have received a printed copy of our proxy materials, you can appoint a proxy to vote your shares of Common Stock (i) by using the Internet (www.proxypush.com/wgo)(www.proxyvote.com), (ii) by calling the toll-free telephone number (1-866-883-3382)(1-800-690-6903) or (iii) you may indicate your vote by completing, signing and dating the proxy card where indicated and returning the card to usVote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717 by 12:0011:59 p.m. CentralEastern Standard Time on December 12, 2016.16, 2019.

If a proxy card is executed and returned, it may nevertheless be revoked at any time in accordance with the following

instructions. A person may revoke a proxy electronically by entering a new vote via the Internet or by telephone or a proxy may be revoked by (i) giving written notice to the Secretary of the Company (the “Secretary”), (ii) subsequently granting a later-dated proxy,

(iii) attending the Meeting and voting in personvirtually or (iv) executing a proxy designating another person to represent you at the Meeting and voting by your representative at the Meeting. Unless revoked, the shares represented by validly executed proxies will be voted at the Meeting in accordance with the instructions indicated thereon. To revoke a proxy by telephone or the Internet, you must do so by 12:00 p.m. Central Standard Time on December 12, 201616, 2019 (following the directions on the instructions as set forth in the Notice of Internet Availability of Proxy Materials or in the printed proxy materials received by request). Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request. If the Meeting is adjourned for any reason, the proxies can vote your Common Stock on the new Meeting date as well, unless you have revoked your proxy instructions.

If no instructions are indicated on a proxy that is signed and received by us, it will be voted: (i)for the election of the twonominees for director named below (Item1), (ii) for the advisory approval of executive compensation (Item 2), (iii) for the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accountant for Fiscal 2017 (Item 3), and (iv)in the discretion of the named proxies upon such other matters as may properly come before the Meeting.

VOTING SECURITIES AND PRINCIPAL HOLDERSVoting Securities and Principal Holders Thereof

The following table contains information with respect to the ownership of the Common Stock by each person known to us who is the beneficial owner of more than 5% of the outstanding Common Stock. This information is based on ownership reported as of December 31, 2015October 22, 2019 according to SEC filings of the beneficial owners listed beneficial ownerbelow unless more recent information was appropriate to be used.

|

| | | |

| Name and Address of Beneficial Owner | Shares of Common Stock Owned Beneficially | | % of Common Stock(1) |

Royce & Associates, LLC 745 Fifth Avenue New York, New York 10151 | 3,041,377 | (2) | 11.3% |

BlackRock, Inc. 55 East 52nd Street New York, New York 10055 | 2,724,023 | (3) | 10.1% |

Invesco Ltd. 1555 Peachtree Street NE Suite 1800 Atlanta, GA 30309 | 2,420,556 | (4) | 9.0% |

Cooke & Bieler LP 1700 Market Street Suite 3222 Philadelphia, PA 19103 | 2,075,450 | (5) | 7.7% |

Franklin Resources, Inc. One Franklin Parkway San Mateo, California 94403 | 1,798,750 | (6) | 6.7% |

|

| | | |

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | | % of Common Stock(1) |

BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | 4,237,554 shares of Common Stock | (2) | 13.37% |

Dimensional Fund Advisors LP Building One 6300 Bee Cave Road Austin, TX 78746 | 2,105,885 shares of Common Stock | (3) | 6.65% |

Cooke & Bieler LP 1700 Market Street Suite 3222 Philadelphia, PA 19103 | 1,912,165 shares of Common Stock | (4) | 6.03% |

The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | 1,793,111 shares of Common Stock | (5) | 5.66% |

LSV Asset Management 155 N. Wacker Drive Suite 4600 Chicago, IL 60606 | 1,642,100 shares of Common Stock | (6) | 5.18% |

| |

| (1) | Based on 26,901,14631,684,985 outstanding shares of Common Stock on October 10, 2016.22, 2019. |

| |

| (2) | The number of shares listed for Royce & Associates is basedBased on information provided in a Schedule 13G/A filed with the SEC on January 28, 2016.31, 2019 by BlackRock, Inc., a parent holding company ("Blackrock"). BlackRock reported that it has sole power to vote or direct the vote of 4,168,816 shares and sole power to dispose of or direct the disposition of 4,237,554 shares. |

| |

| (3) | The number of shares listed for BlackRock, Inc. is basedBased on a Schedule 13G/A filed with the SEC on September 9, 2016. |

| |

(4) | The number of shares listed for Invesco Ltd is based on a Schedule 13G filed with the SEC on February 12, 2016. |

| |

(5) | The number of shares listed for Cooke & Bieler LP is based oninformation provided in a Schedule 13G/A filed with the SEC on February 10, 2016. |

| |

(6) | The number8, 2019 by Dimensional Fund Advisors LP, an investment adviser ("DFA"). DFA reported that it has sole power to vote or direct the vote of 2,007,737 shares listed for Franklin Resources, Inc. is based on aand sole power to dispose of or direct the disposition of 2,105,885 shares. DFA notes in its Schedule 13G/A filed withfiling that it furnishes investment advice to four investment companies registered under the SEC on February 11, 2016.Investment Company Act of 1940, and serves as investment manager or sub-adviser to certain other commingled funds, group trusts and separate accounts (collectively, the "Funds"). In certain cases, subsidiaries of DFA may act as an adviser or sub-adviser to certain Funds. In its role as investment adviser, sub-adviser and/or manager, DFA or its subsidiaries (collectively, "Dimensional") may possess voting and/or investment power over the securities of the Company that are owned by the Funds, and may be deemed to be the beneficial owner of the shares of the Company held by the Funds. However, all securities reported in its Schedule 13G/A are owned by the Funds and Dimensional disclaims beneficial ownership of such securities. |

| |

| (4) | Based on information provided in a Schedule 13G/A filed with the SEC on February 11, 2019 by Cooke & Bieler LP, an investment adviser. Cooke & Bieler LP reported that it has shared power to vote or direct the vote of 1,702,973 shares and shared power to dispose of or direct the disposition of 1,912,165 shares. |

| |

| (5) | Based on information provided in a Schedule 13G filed with the SEC on February 12, 2019 by The Vanguard Group, an investment adviser. The Vanguard Group reported that it has sole voting power over 63,876 shares, shared voting power over 2,300 shares, sole dispositive power over 1,730,138 shares and shared dispositive power over 62,973 shares. |

| |

| (6) | Based on information provided in a Schedule 13G filed with the SEC on February 13, 2019 by LSV Asset Management, an investment adviser. LSV Asset Management reported that it has sole power to vote or direct the vote of 920,548 shares and sole power to dispose of or direct the disposition of 1,642,100 shares. |

The following table sets forth certain information known to us with respect to beneficial ownership of our Common Stock, as defined in Rule 13(d)(3)13d-3 under the Exchange Act, at October 10, 201622, 2019 for (i) each of our directors and director nominees, (ii) each named executive officer of the Company as of the end of Fiscal 2016 named("NEO") in the summary compensation table below, and (iii) all current executive officers and directors as a group. Except as otherwise indicated, the named beneficial owner has sole voting and investment power with respect to the shares held by such beneficial owner. |

| | | | | | | | | | |

| Name | Shares of Common Stock Owned Beneficially(1)(2) | Exercisable Stock Options | Winnebago Stock Units(2) | Total Shares of Common Stock Owned Beneficially(1) | % of Common Stock(3) |

Christopher J. Braun (4) | — |

| — |

| — |

| — |

| (5) |

|

| Robert M. Chiusano | 19,960 |

| — |

| 22,412 |

| 42,372 |

| (5) |

|

| Jerry N. Currie | 21,000 |

| — |

| — |

| 21,000 |

| (5) |

|

| S. Scott Degnan | 33,860 |

| — |

| — |

| 33,860 |

| (5) |

|

| Lawrence A. Erickson | 18,000 |

| — |

| 32,613 |

| 50,613 |

| (5) |

|

| William C. Fisher | 6,000 |

| — |

| 3,427 |

| 9,427 |

| (5) |

|

| Scott C. Folkers | 33,717 |

| — |

| — |

| 33,717 |

| (5) |

|

| Michael J. Happe | 10,000 |

| — |

| — |

| 10,000 |

| (5) |

|

| Daryl W. Krieger | 40,981 |

| — |

| — |

| 40,981 |

| (5) |

|

David W. Miles (4) | — |

| — |

| — |

| — |

| (5) |

|

| Sarah N. Nielsen | 53,830 |

| — |

| — |

| 53,830 |

| (5) |

|

| Martha T. Rodamaker | 11,500 |

| — |

| 8,449 |

| 19,949 |

| (5) |

|

| Mark T. Schroepfer | 29,500 |

| — |

| 2,549 |

| 32,049 |

| (5) |

|

| Directors and executive officers as a group (17 persons) | 341,215 |

| — |

| 69,450 |

| 410,665 |

| 1.5 | % |

|

| | | | | | | | | |

| Name | Shares of

Common

Stock Owned Outright(1) | Exercisable

Stock

Options(2) | Winnebago

Stock

Units(3) | Total Shares

of Common

Stock Owned

Beneficially | % of

Common

Stock(4) |

| Maria F. Blase | 2,997 |

| — |

| — |

| 2,997 |

| (5) |

| Christopher J. Braun | 12,737 |

| — |

| — |

| 12,737 |

| (5) |

| Stacy L. Bogart | 1,145 |

| 3,274 |

| — |

| 4,419 |

| (5) |

| Robert M. Chiusano | 27,697 |

| — |

| 26,425 |

| 54,122 |

| (5) |

| Donald J. Clark | 764,426 |

| — |

| — |

| 764,426 |

| 2.4% |

| William C. Fisher | 19,737 |

| — |

| 7,851 |

| 27,588 |

| (5) |

| Michael J. Happe | 50,651 |

| 73,253 |

| — |

| 123,904 |

| (5) |

| Brian D. Hazelton | 18,831 |

| 16,439 |

| — |

| 35,270 |

| (5) |

| Bryan L. Hughes | 18,733 |

| 9,393 |

| — |

| 28,126 |

| (5) |

| David W. Miles | 9,737 |

| — |

| 922 |

| 10,659 |

| (5) |

| Richard D. Moss | 8,137 |

| — |

| — |

| 8,137 |

| (5) |

| John M. Murabito | 6,837 |

| — |

| — |

| 6,837 |

| (5) |

| Directors and executive officers as a group (17 persons) | 1,033,848 |

| 148,177 |

| 35,198 |

| 1,217,223 |

| 3.8% |

| |

| (1) | Includes the following shares held jointly withnot currently outstanding but deemed beneficially owned because of the right to acquire them pursuant to restricted stock units that vest within 60 days or by spousehave vested but have not yet been distributed: 2,997 shares for each of Ms. Blase and shares held as custodian, beneficial ownership of which is disclaimed.Messrs. Braun, Chiusano, Fisher, Miles, Moss and Murabito. |

| |

| (2) | Includes shares underlying stock options that are currently exercisable or become exercisable within 60 days. |

| |

| (3) | Winnebago Stock Units held under our Directors' Deferred Compensation Plan as of October 10, 201622, 2019 (see further discussion of the plan in the Director Compensation section). These units are tovested and will be settled 100% in Common Stock upon the earliest of the following events: director's termination of service, death or disability or a "change in control" of the Company, as defined in the plan. |

| |

(3)(4) | Based on 26,901,14631,684,985 outstanding shares of Common Stock on October 10, 2016, together with 0 shares that directors and executive officers as a group have the right to acquire within 60 days of October 10, 2016 through the exercise of stock options, and shares representing the 69,450 Winnebago Stock Units held by directors under our Directors' Deferred Compensation Plan as of October 10, 2016. |

| |

(4) | Mr. Braun and Mr. Miles joined the Board in December 2015.22, 2019. |

SECTION16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Corporate Governance

Board Leadership Structure

Section 16(a) of the Exchange Act requires our officers and directors and persons who own more than 10% of the our Common Stock (collectively, “Reporting Persons”) to file reports of ownership and changes in ownership with the SEC. Reporting Persons are required by the SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based solely on its review of the copies of such forms received or written representations from certain Reporting Persons that no Forms 5 were required for those persons, we believe that, during Fiscal 2016, all Reporting Persons complied with all applicable filing requirements.

BOARD OF DIRECTORS, COMMITTEES OF THE BOARD AND CORPORATE GOVERNANCE

Board Leadership Structure. Our By-Laws and Corporate Governance Policy delegate to the Board of Directors the right to exercise its discretion to either separate or combine the offices of Board Chair and Chief Executive Officer ("CEO"). This decision is based upon the Board's determination of what is in the best interests of Winnebago Industries and our

shareholders, in light of then‑currentthen-current and anticipated future circumstances and taking into consideration succession planning, skills and experience of the individual(s) filling those positions, and other relevant factors.

Randy Potts, our former Chair, CEO, and President, retired effective August 6, 2015. At that time, Lawrence A. Erickson, then Lead Director, was elected as the Chair. At the October 14, 2015, Board meeting, the Board determined that, in their judgment, the Chair and CEO role should be split, with the Chair being one of the independent directors and the CEO being a non-independent, employee director. The Board determined that this was the proper corporate governance practice for us at the time.

Following Mr. Potts' retirement, Robert J. Olson, former Chair and CEO who had retired from the Company's Board in December 2014, returned and was named the interim CEO. He served as such from August 6, 2015 until September 24, 2015. On September 25, 2015, the Board elected Mr. Erickson to fill the role of interim CEO for no employment compensation until a permanent CEO, Mr. Happe, was appointed President and CEO on January 18, 2016. On June 14, 2016, Mr. Erickson stepped down as the Chair of the Board, while

remaining a director. The Board elected Mr. Chiusano to succeed him as Chair.

The Board, as part of its continuing obligation to determine the appropriate role for the Chair, has concluded that at this time the Company should have an independent Chair. The Board concluded that this structure provides us with a strong governance and leadership structure that is designed to exercise independent oversight of members of our management team ("Management") and key issues related to strategy and risk. Mr. Chiusano, an independent director,served as Chair from June 2016 to June 2019. The Board thanks him for his sound business advice, valued counsel and many contributions to the Company. The Board appointed Mr. Miles, an independent director, to serve as Chair beginning on June 16, 2019.

In addition, only independent Directorsdirectors serve on the Audit Committee, the Human Resources Committee and the

Nominating and Governance Committee of the Board, Non-Employee DirectorsBoard. Non-employee directors regularly hold executive sessions of the Board outside the presence of the CEO or any other employee under the Corporate Governance Policy that requires the Board's independent Directorsdirectors to hold executive sessions at least once each year; such executive sessions are led by the Chair; and we have established a Shareholder and Other Interested Party Communications Policy for all shareholders and other interested parties to communicate directly with the Board.Chair.

The Board recognizes that, depending on the specific characteristics and circumstances of the Company, other leadership structures might also be appropriate. The Company is committed to reviewing this determination on an annual basis.

Lead Director. At this time the Board has determined that the Chair be independent. However, the Board may in the future determine that the CEO could serve as Chair. If that were to occur, according

According to the Company's Corporate Governance

Policy, whenwhenever the Chair of the Board is also the CEO or an employee of the Company, the Non-Employee Directorsnon-employee directors shall select an independent director to preside or lead at each executive session (the “Lead Director”). The Company's Corporate Governance Policy sets forth the authority, duties and responsibilities of the Board of Directors'any Lead Director as follows: convene and chair meetings of the Non-Employee Directors in executive session at each Board meeting; convene and chair meetings of the independent directors in executive session no less than once each year; preside at all meetings of the Board at which the Chair and CEO is not present, including executive sessions of the non-management directors and independent directors; solicit the Non-Employee Directors for advice on agenda items for meetings of the Board; serve as a liaison between the Chair and CEO and the Non-Employee Directors; collaborate with the Chair and CEO in developing the agenda for meetings of the Board and approve such agendas; consult with the Chair and CEO on information that is sent to the Board; collaborate with the Chair and the Chairs of the standing committees in developing and managing the schedule of meetings of the Board and approve such schedules; and if requested by major shareholders, ensure that he or she is available for consultation and direct communication. In performing the duties described above, the Lead Director is expected to consult with the Chairs of the appropriate Board committees and solicit their participation. The Lead Director also performs such other duties as may be assigned to the Lead Director by the Company's By-Laws or the Board.Director.

Required Committees of the Board. Board

The Board has established standing Audit, Human Resources, and Nominating and Governance and Finance Committees to assist it in the discharge of its responsibilities. Each of such committees is governed by a written charter. A description of each committee, including its membership, principal responsibilities, and meeting frequency, is set forth below.

|

| | | |

| | Committees of the Board |

| | Audit | Human Resources | Nominating and Governance |

Christopher J. Braun (1) | X | | |

Robert M. Chiusano (Chair) (1)(2) | | X | |

Jerry N. Currie (1) | | | X |

Lawrence A. Erickson (3) | X | X | |

William C. Fisher (1) | | Chair | |

David W. Miles (1) | X | | X |

Martha T. Rodamaker (1) | | X | Chair |

Mark T. Schroepfer (1)(3) | Chair | | |

| Number of meetings in Fiscal 2016 | 4 | 4 | 4 |

Conducted a self-assessment of its performance (4) | X | X | X |

|

| | | | |

| | Committees of the Board |

| | Audit | Human Resources | Nominating and Governance | Finance |

Maria F. Blase(1)(2) | X | | | Chair |

Christopher J. Braun (1) | | X | X | |

Robert M. Chiusano (1) | | X | | X |

William C. Fisher (1) | X | | Chair | |

David W. Miles (Chair) (1)(2) | X | | | X |

Richard D. Moss (1)(2) | Chair | | | X |

John M. Murabito (1) | | Chair | X | |

| Number of meetings in Fiscal 2019 | 7 | 5 | 5 | 5 |

| Conducted a self-assessment of its performance | X | X | X | X |

| |

| (1) | Determined to be "independent" under applicable listing standards of the NYSE and our Director Nomination Policy (defined below)New York Stock Exchange ("NYSE"). |

| |

| (2) | As of September 25, 2015, Mr. Erickson became the interim CEO and was no longer considered independent and, therefore, did not serve on any of these mandatory committees. Upon Mr. Happe becoming President and CEO, Mr. Erickson resumed his role on the Human Resources Committee at the March and June meetings. |

| |

(3) | Designated as an "audit committee financial expert" for purposes of Item 407, Regulation S-K under the Securities Act of 1933, as amended. |

|

| | |

(4) | For no compensation | |

| Audit Committee |

Each year, the committee appoints the independent registered public accountant to examine our financial statements. It reviews with representatives of the independent registered public accountant the auditing arrangements and scope of the independent registered public accountant's examination of the books, results of those audits, any non-audit services, their fees for all such services and any problems identified by and recommendations of the independent registered public accountant regarding internal controls. Others in regular attendance for part of the Audit Committee meeting typically include: the Board Chair; the CEO; the CFO; the Vice President, General Counsel and Secretary; and the Corporate Controller.

The Audit Committee meets at least annually with the CFO, the internal auditors and the independent auditors in separate executive sessions. The Audit Committee is also prepared to meet privately at any time at the request of the independent registered public accountant or members of our Management to review any special situation arising on any of the above subjects. The Audit Committee also performs other thanduties as set forth in its written charter which is available for review on the Corporate Governance portion of the Investor Relations section of our Web Site at http://www.winnebagoind.com. The Audit Committee annually reviews its written charter and recommends to the Board fees compensationsuch changes as it deems necessary. |

|

|

| Members |

| Richard D. Moss, Chair |

| Maria F. Blase |

| William C. Fisher |

| David W. Miles |

| |

The principal responsibilities of each of these committees are described below. |

| | |

| | |

| Nominating and Governance Committee |

The Nominating and Governance Committee's charter, which is available for review on the Corporate Governance portion of the Investor Relations section of our Web Site at http://www.winnebagoind.com, establishes the scope of the committee's duties to include: (1) adopting policies and procedures for identifying and evaluating director nominees, including nominees recommended by shareholders; (2) identifying and evaluating individuals qualified to become Board members, considering director candidates recommended by shareholders and recommending that the Board select the director nominees for the next annual meeting of shareholders; (3) establishing a process by which shareholders and other interested parties are able to communicate with members of the Board; (4) developing and recommending to the Board a Corporate Governance Policy applicable to the Company; and (5) reviewing and approving Related Person Transactions (as defined below).

The committee recommended to the Board the director-nominees proposed in this Proxy Statement for election by the shareholders. The Nominating and Governance Committee reviews the qualifications of, and recommends to the Board, candidates to fill Board vacancies as they may occur during the year. The Nominating and Governance Committee will consider suggestions from all sources, including shareholders, regarding possible candidates for director. See also "Fiscal 2020 Shareholder Proposals" for a summary of the procedures that shareholders should follow to nominate a director. |

|

|

| Members |

| William C. Fisher, Chair |

| Christopher J. Braun |

| John M. Murabito |

| |

Audit Committee. Each year, the committee appoints the independent registered public accountant to examine our financial statements. It reviews with representatives of the independent registered public accountant the auditing arrangements and scope of the independent registered public accountant's examination of the books, results of those audits, any non-audit services, their fees for all such services and any problems identified by and recommendations of the independent registered public accountant regarding internal controls. Others in regular attendance for part of the Audit Committee meeting typically include: the Board Chair; the CEO; the CFO; the Vice President, General Counsel and Secretary; and the Treasurer/Director of Finance. The Audit Committee meets at least annually with the CFO, the internal auditors and the independent auditors in separate executive sessions. The Audit Committee is also prepared to meet privately at any time at the request of the independent registered public accountant or members of our Management to review any special situation arising on any of the above subjects. The Audit Committee also performs other duties as set forth in its written charter which is available for review on the Corporate Governance portion of the Investor Relations section of our Web Site at http://www.winnebagoind.com. The Audit Committee annually reviews its written charter and recommends to the Board such changes as it deems necessary. Reference is also made to the “Report of the Audit Committee” herein.

Human Resources Committee. The Human Resources Committee's charter, which is available for review on the Corporate Governance portion of the Investor Relations section of our Web Site at http://www.winnebagoind.com, establishes the scope of the committee's duties to include: (1) reviewing and approving corporate goals and objectives relevant to compensation of our CEO, evaluating performance and compensation of our CEO in light of such goals and objectives and establishing compensation levels for other executive officers; (2) overseeing the evaluation of our executive officers (other than the CEO) and approving the general compensation program and salary structure of such executive officers; (3) administering and approving awards under our incentive compensation and equity-based plan; (4) reviewing and approving any executive employment agreements, severance agreements, and change in control agreements; (5) from time to time, reviewing the list of peer group companies to which we compare ourself for compensation purposes; (6) reviewing and approving Board retainer fees, attendance fees, and other compensation, if any, to be paid to Non-Employee Directors; (7) reviewing and discussing with Management the Compensation Discussion and Analysis section and certain other disclosures including those relating to compensation advisors, compensation risk and say on pay, as applicable for our Form 10-K and proxy statement; and (8) preparing an annual report on executive compensation for our Form 10-K and proxy statement.

Role of Executive Officers—In Fiscal 2016, the Human Resources Committee delegated authority to designated members of Management to approve employment compensation packages for certain employees, not including the Named Executive Officers (NEOs) (as defined below),

|

| | |

| | |

| Finance Committee

|

The Finance Committee's charter, which is available for review on the Corporate Governance portion of the Investor Relations section of our Web Site at http://www.winnebagoind.com, establishes the scope of the committee's duties to include: recommending to the Board financial policies, goals, and budgets that support the financial health, strategic goals, mission, and values of the Company, including the long-range financial plan of the Company, and annual capital budgets; evaluating major capital expenditures and financial transactions.

The Finance Committee has oversight in the following specific areas: strategic transactions, capitalization and debt and equity offerings, capital expenditure plans, financial review of business plans, rating agencies and investor relations, dividends, share repurchase authorizations, investment policy, debt management, tax strategies, and financial risk management. |

|

|

| Members |

| Maria F. Blase, Chair |

| Robert M. Chiusano |

| David W. Miles |

| Richard D. Moss |

|

|

under certain circumstances. During Fiscal 2016, Mr. Happe as CEO, recommended to the committee proposals for base salary, target short-term incentive levels, actual short-term incentive payouts and long-term incentive grants for select NEOs for Fiscal 2016. The committee separately considers, discusses, modifies as appropriate, and takes action on such proposals and the compensation of the CEO and other NEOs. See “Compensation Discussion and Analysis-Role of Executive Officers in Compensation Decisions” below for further detail.

Role of Compensation Consultants — The Human Resources Committee has periodically utilized an outside compensation consultant for matters relating to executive compensation. In Fiscal 2015, the committee retained a compensation consultant, Willis Towers Watson, to conduct a new study on executive compensation that was reviewed by the committee in June 2015. As described in "Compensation Discussion and Analysis - Competitive Benchmarking" below, compensation decisions made during Fiscal 2015 relied in part upon the 2015 Willis Towers Watson study. In addition, in late Fiscal 2016, the committee retained Willis Towers Watson to conduct a study on the Annual and Long Term Incentive plans.

Nominating and Governance Committee. The Nominating and Governance Committee's charter, which is available for review on the Corporate Governance portion of the Investor Relations section of our Web Site at http://www.winnebagoind.com, establishes the scope of the committee's duties to include: (1) adopting policies and procedures for identifying and evaluating director nominees, including nominees recommended by shareholders; (2) identifying and evaluating individuals qualified to become Board members, considering director candidates recommended by shareholders and recommending that the Board select the director nominees for the next annual meeting of shareholders; (3) establishing a process by which shareholders and other interested parties will be able to communicate with members of the Board; (4) developing and recommending to the Board a Corporate Governance Policy applicable to the Company; and (5) reviewing and approving Related Person Transactions (as defined below). The committee recommended to the Board the director-nominees proposed in this Proxy Statement for election by the shareholders. The Nominating and Governance Committee reviews the qualifications of, and recommends to the Board, candidates to fill Board vacancies as they may occur during the year. The Nominating and Governance Committee will consider suggestions from all sources, including shareholders, regarding possible candidates for director in accordance with our Director Nomination Policy, as discussed below. See also "Fiscal Year 2017 Shareholder Proposals" and Appendix A "Director Nomination Policy" below for a summary of the procedures that shareholders must follow to nominate a director.

Finance Committee. At the June 15, 2016, Board meeting the need for a Finance Committee to address the use of capital by the Company was discussed. Following an exploration process headed by David Miles and Don Heidemann, along with drafting a proposed charter for the Finance Committee, the Board took action and the Finance Committee was formed and the first meeting was held October 11, 2016. The Finance Committee's charter, which is available for review on the Corporate Governance portion of the Investor Relations

section of our Web Site at http://www.winnebagoind.com, establishes the scope of the committee's duties to include: recommending to the Board financial policies, goals, and budgets that support the financial health, strategic goals, mission, and values of the Company, including the long-range financial plan of the Company, and annual capital budgets; evaluating major capital expenditures and financial transactions. The Finance Committee will have oversight in the following specific areas: strategic transactions, capitalization and debt and equity offerings, capital expenditure plans, delegated authority limits for capital expenditures, financial review of business plans, rating agencies and investor relations, dividends, share repurchase authorizations, investment policy, employee benefit plans, tax strategies, and financial risk management. |

| | |

| | |

| Human Resources Committee |

The Human Resources Committee's charter, which is available for review on the Corporate Governance portion of the Investor Relations section of our Web Site at http://www.winnebagoind.com, establishes the scope of the committee's duties to include: (1) reviewing and approving corporate goals and objectives relevant to compensation of our CEO, evaluating performance and compensation of our CEO in light of such goals and objectives and establishing compensation levels for other executive officers; (2) overseeing the evaluation of our executive officers (other than the CEO) and approving the general compensation program and salary structure of such executive officers; (3) administering and approving awards under our incentive compensation and equity-based plan; (4) reviewing and approving all executive officer compensation, including any executive employment agreements, severance agreements, and change in control agreements; (5) from time to time, reviewing the list of peer group companies used for compensation purposes; (6) reviewing and approving Board retainer fees, attendance fees, and other compensation, if any, to be paid to non-employee directors; (7) reviewing and discussing with Management the Compensation Discussion and Analysis section and certain other disclosures, including those relating to compensation advisors, compensation risk and the "say on pay" vote, as applicable for our Form 10-K and proxy statement; and (8) preparing the committee's annual report on executive compensation for our Form 10-K and proxy statement.

During Fiscal 2018, Mr. Happe recommended to the Committee proposals for base salary as well as short-term and long-term incentive grants for Fiscal 2019. Following Fiscal 2019, Mr. Happe recommended Fiscal 2019 incentive payments based upon financial and individual performance results. The committee separately considers, discusses, modifies as appropriate, and takes action on such proposals and determines the compensation of the CEO and other NEOs. See “Compensation Discussion and Analysis - Determination of Compensation - Role of Management” below for further detail.

Role of Compensation Consultants — The Human Resources Committee is authorized to retain an outside compensation consultant for matters relating to executive compensation. In Fiscal 2019, the committee retained Semler Brossy Consulting Group LLC ("Semler Brossy") to advise on certain executive compensation-related matters, as further described in the "Compensation Discussion and Analysis" Section. |

|

|

| Members |

| John M. Murabito, Chair |

| Christopher J. Braun |

| Robert M. Chiusano |

|

|

Business Development Advisory Committee. The Business Development and Advisory Committee was a non-mandatory committee and after not meeting during the 2016 fiscal year and following the hiring of Ashis Bhattacharya as the Vice President of Strategic Planning and Development, it was felt the role of the committee was no longer needed and it was dissolved at the June Board meeting.

Our Board of Directors held five regular meetings and three special meetings during Fiscal 2016.2019. Actions taken by any committee of the Board are reported generally to the Board of Directors at its next meeting. During Fiscal 2016,2019, all of the directors attended more than 75% of the aggregate of Board of Directors' meetings and meetings of committees of the Board on which they served. Our Corporate Governance Policy, discussed below, encourages, but does not require, Board members to attend the Annual Meeting.annual meetings of shareholders. At the last Annual Meeting,annual meeting of shareholders, all of the then-current directors were in attendance.

Executive Sessions of Non-Employee Directors —Independent Directorsdirectors meet privately in executive sessions to consider such matters as they deem appropriate, without Management being present, as a routinely scheduled agenda item for every Board meeting and at least once a year.year pursuant to the requirements of the NYSE. During Fiscal 2016,2019, all Non-Employee Directorsnon-employee directors were independent, except Mr. Erickson as noted above.independent.

The Board has adopted the Corporate Governance Policy which incorporates the corporate governance principles by which we operate. The Nominating and Governance Committee annually reviews the Corporate Governance Policy and recommends any changes

Procedures With Respect to the Board. A copyNominations of our Corporate Governance Policy is available on the Investor Relations section of our Web Site at http://www.winnebagoind.com.Directors

Nominations of Directors Policy.The Nominating and Governance Committee has adopted a Director Nomination Policy (attached as Appendix A to this Proxy Statement) (the "Director Nomination Policy") to assist it in fulfilling its duties and responsibilities in consideration of director nominations.

Briefly, the Nominating and Governance Committee will consider as a candidate any director who has indicated to the Nominating and Governance Committee that he or she is willing to stand for re-election, and who has not reached the age of 72 years prior to the date of re-election to the Board, as

well as any other person who is appropriately recommended by any shareholder who provides the required information and certifications within the specified time requirements, as set forth in the Director Nomination Policy.shareholder. The Nominating and Governance Committee may also undertake its own search process for candidates and may retain the services of professional search firms or other third parties to assist in identifying and evaluating potential nominees.

In considering a potential nominee for the Board, candidates also will be assessed in the context of the then‑currentthen-current composition of the Board, the operating requirements of the Company and the long‑termlong-term interests of all shareholders. In conducting this assessment, the Nominating and Governance Committee will consider diversity (including, but not limited to, age, experience and skills) and such other factors as it deems appropriate given the then‑currentthen-current and anticipated future needs of the Board and the Company in order to maintain a balance of perspectives,

qualifications, qualities and skills on the Board. Although the Nominating and Governance Committee may seek candidates that have different qualities and experiences at different times in order to maximize the aggregate experience, qualities and strengths of the Board members, nominees for each election or appointment of directors will be evaluated using a substantially similar process, without regard to race, religion, gender, national origin or other protected category, and under no circumstances will the Nominating and Governance Committee evaluate nominees recommended by a shareholder of the Company pursuant to a process substantially different than that used for other nominees for the same election or appointment of directors. The Nominating and Governance Committee considers and assesses the implementation and effectiveness of this process in connection with Board nominations annually to assure that the Board contains an effective mix of individuals to best further the Company's long-term business interests. Audit, Human Resources, and Nominating and Governance Committees all perform annual self-assessments of their effectiveness.

Other than the foregoing, there are no stated minimum criteria for director nominees, although theThe Nominating and Governance Committee may also consider such other factors as it may deem are in the best interests of the Company and its shareholders. The Nominating and Governance Committee does, however, believe it appropriate for at least one member of the Board and Audit Committee to meet the criteria as an "audit committee financial expert" as defined by SEC rules.

Policy and Procedures With Respect to Related Person Transactions.Transactions

The Board of Directors adopted the Winnebago Industries, Inc. Related Person Transaction Policy and Procedures, which provides that the Nominating and Governance Committee will review and approve Related Person Transactions (as defined below); provided that the Human Resources Committee will review and approve the compensation of each employee who is an immediate family member of a director or executive officer and whose compensation exceeds $120,000. The Chair of the Nominating and Governance Committee has delegated authority to its Chair to act between committee meetings.

The policy defines a “Related Person Transaction” as a transaction, arrangement or relationship (or any series of

similar transactions, arrangements or relationships) in which we were, are or will be a participant and the amount involved exceeds $120,000 and in which any Related Person (as defined below) had, has or will have a direct or indirect material interest, other than:

| |

| (1) | competitively bid or regulated public utility services transactions, |

| |

| (2) | transactions involving trustee type services, |

| |

| (3) | transactions in which the Related Person's interest arises solely from ownership of our equity securities and all equity security holders received the same benefit on a pro rata basis, |

| |

| (4) | an employment relationship or transaction involving an executive officer and any related compensation solely resulting from that employment relationship or transaction if: |

| |

| (i) | the compensation arising from the relationship or transaction is or will be reported pursuant to the SEC's executive and director compensation proxy statement disclosure rules; or |

| |

| (ii) | the executive officer is not an immediate family member of another executive officer or director and such compensation would have been reported under the SEC's executive and director compensation proxy statement disclosure rules as compensation earned for services if the executive officer was a NEO, as that term is defined in the SEC's executive and director compensation proxy statement disclosure rules, and such compensation has been or will be approved, or recommended to our Board of Directors for approval, by the Human Resources Committee of our Board of Directors, or |

| |

| (5) | if the compensation of or transaction with a director is or will be reported pursuant to the SEC's executive and director compensation proxy statement disclosure rules. |

“Related Person” is defined as (1) each director, director nominee and executive officer, (2) 5% or greater beneficial owners, or (3) immediate family members of the foregoing persons and (4) any entity in which any of the foregoing persons is a general partner or principal or in a similar position or in which such person and all other related persons to such person has a 10% or greater beneficial interest.persons.

The Nominating and Governance Committee will assess whether a proposed transaction is a Related Person Transaction for purposes of the policy. Under the policy, the Chair of the Nominating and Governance Committee has the authority to pre-approve or ratify (as applicable) any Related Person Transaction with a Related Person in which the aggregate amount involved is expected to be less than $500,000.

The policy recognizes that certain Related Person Transactions are in our and our shareholders' best interests. Each of the following Related Person Transactions are deemed to be pre-approved by the Nominating and Governance Committee pursuant to the policy, even if the aggregate amount involved will exceed $120,000:

Certain transactions with other companies.companies. Any transaction with another company at which a Related Person's only relationship is as an employee (other than

an executive officer), director or beneficial owner of less than 10% of that company's shares or other equity securities, if the aggregate amount involved does not exceed the greater of $1 million, or 2% of that company's total annual revenues.

Certain Company charitable contributions.contributions. Any charitable contribution, grant or endowment by Winnebago Industries or the Winnebago Industries Foundation to a charitable organization, foundation or university at which a Related Person's only relationship is as an employee (other than an officer), if the aggregate amount involved does not exceed $100,000.

The approval procedures in the policy identify the factors the Nominating and Governance Committee will consider in evaluating whether to approve or ratify Related Person Transactions or material amendments to pre-approved Related Person Transactions. The Nominating and Governance Committee will consider all of the relevant facts and circumstances, available to the Nominating and Governance Committee, including (if applicable) but not limited to: whether the Related Person Transaction is on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances, the extent of the Related Person's interest in the transaction, and whether the proposed Related Person Transaction is in compliance with or would require disclosure under applicable SEC rules and regulations, NYSE listing requirements and our policies.

The policy provides for the annual pre-approval by the Nominating and Governance Committee of certain Related Person Transactions that are identified in the policy, as the policy may be supplemented and amended. During Fiscal 2016, there were no Related Person Transactions2019, the only related party transactions involved Donald Clark, one of our executive officers, who has a 20% ownership interest in Three Oaks, LLC, an entity which owns the land and buildings that Grand Design RV, LLC ("Grand Design") leases in order to disclose.operate its business. These related party transactions consist of the following: (i) On October 25, 2018, Grand Design purchased approximately 31.7 acres of land from Three Oaks, LLC for $729,100, (ii) Grand Design has paid $1,963,296 to Three Oaks, LLC under its lease with Three Oaks, LLC that was entered into on November 8, 2016 and amended on February 7, 2018, and (iii) Grand Design has paid $900,000 to Three Oaks, LLC under its other existing lease with Three Oaks, LLC, which was entered into on October 2, 2016, for a total of $2,863,296 paid to Three Oaks, LLC during Fiscal 2019 under its leases with them. Each of these transactions with Three Oaks, LLC was approved by the Nominating and Governance Committee or the full Board.

Corporate Governance Policies and CodesCode of Conduct.Conduct

The Board of Directors has adopted a Corporate Governance Policy, a Director Nomination Policy, a Shareholder and Other Interested Party Communications Policy and written charters for its Audit Committee, Human Resources Committee, and Nominating and Governance Committee and Finance Committee.

TheOn August 15, 2018, the Board of Directors also has adopted a revised Code of EthicsConduct applicable to all of our directors, officers, and employees and business partners, which superseded the Company's previous Code of Ethics for CEOEthics. The revised Code of Conduct incorporates a number of revisions intended to make the document more accessible, broadly applicable, comprehensive and Senior Financial Officers (including the CFO and the Treasurer/Director of Finance). current.

These policies, charters, codes and other items relating to our governance are available on the Corporate Governance portion of the Investor Relations section of our Web Site at http://www.winnebagoind.com. These documents are also available in print free of charge to any shareholder who requests them in writing from: Winnebago Industries, Inc., Attn: Vice President-General Counsel and Secretary, 605 West Crystal Lake Road, Forest City, Iowa 50436.13200 Pioneer Trail, Suite 150, Eden Prairie, MN 55347. Information contained on our Web Site is not incorporated into this Proxy Statement or other securities filings.

Director Independence.Independence

Under our Corporate Governance Policy and NYSE rules, the Board must have a majority of directors who meet the standards for independence under our Director Nomination Policy and applicable NYSE rules, respectively.independence. The Board must determine, based on a review of all of the relevant facts and circumstances, whether each director satisfies the criteria for independence. In accordance

with the Director Nomination Policy, theThe Board undertook itsan annual review of director and director nominee independence. During this review, the Board considered a variety of relevant facts and circumstances, including a review of all transactions and relationships between each director and director nominee or any member of his immediate family and the Company and its subsidiaries and affiliates known to the Company. The Board also considered whether there were any transactions or relationships between directors, nominees or any member of their immediate family (or any entity of which a director, director nominee or an immediate family member is an executive officer, general partner or significant equity holder). As provided in the Director Nomination Policy, the

The purpose of this review was to determine whether any such relationships or transactions existed or exist that were inconsistent with a determination that the director or nominee is independent. As a result of this review, the Board, at its meeting in October 2016,2019, affirmatively determined that each of Ms. Blase (Class I director), Mr. Braun (Class I director), Mr. Miles (Class I director), Mr. Chiusano (Class II director), Mr. CurrieMoss (Class II director), Mr. EricksonMurabito (Class II director), Mr. Miles (Class I director), Ms. Rodamaker (Class I director),and Mr. Fisher (Class III director) and Mr. Schroepfer (Class III director), are independent as defined by the relevant provisions of applicable law and the NYSE listing standards, and our Director Nomination Policy and that each independent director and nominee has no material relationship with Winnebago Industries. As a result of this review, the Board determined that a majority of directors are independent. The Board determined that Mr. Erickson was not independent when he served as Interim CEO, although he received no compensation for such service.

As a result, all

All members of the Audit Committee, Human Resources Committee, and Nominating and Governance Committee and Finance Committee are independent under theseany additional

independence requirements applicable to such committees under the NYSE and SEC standards.

Mr. Happe (Class III director) is not independent because of his employment as CEO and President of the Company.

Shareholder and Other Interested Party Communications with Directors. The Nominating and Governance Committee has adopted a policy for shareholders and other interested parties to send communications to the Board.

Shareholders and other interested parties who desire to communicate with our directors or a particular director may write to: Winnebago Industries, Inc., Attn: Vice President-General Counsel and Secretary, 605 West Crystal Lake Road, Forest City, Iowa 50436;13200 Pioneer Trail, Suite 150, Eden Prairie, MN 55347; or e-mail: sfolkers@wgo.net.SLBogart@winnebagoind.com. All communications must be accompanied by the following information (i) if the person submitting the communication is a shareholder, a statement of the number of shares of Common Stock that the person holds; (ii) if the person submitting the communication is not a shareholder and is submitting the communication to the non-Managementnon-employee directors as an interested party, the nature of the person's interest in Winnebago Industries;the Company; (iii) any special interest, meaning an interest not in the capacity of a shareholder, of the person in the subject matter of the communication; and (iv) the address, telephone number and e-mail address, if any, of the person submitting the communication. Communications received from shareholders and other interested parties to the Board of Directors will be reviewed by the Vice President-General Counsel and Secretary, or such other person designated by all non-Management membersnon-employee directors of the Board, and if they are relevant to, and consistent with, our operations and policies that are approved by all non-Management members of the Board,appropriate, they

will be forwarded to the Board Chair or applicable Board member or members as expeditiously as reasonably practicable.

Risk Management Oversight Process.Process

We face a number of risks, including financial, technological, operational, strategic and competitive risks. Management is responsible for the day-to-day management of risks we face, while the Board has responsibility for the oversight of risk management. In its risk oversight role, the Board ensures that thereviews and monitors our processes for

identification, management and mitigation of risk by our managementManagement and assesses whether our processes are adequate and functioning as designed.

Our Board is actively involved in overseeing risk management and it exercises its oversight both through the full Board and through three of the standing committees of the Board: the Audit Committee, the Human Resources Committee, and the Nominating and Governance Committee and the Finance Committee. These standing committees exercise oversight of the risks within their areas of responsibility, as disclosed in the descriptions of each of the committees above and in the charters of each of the committees. The Board and these committees receive information used in fulfilling their oversight responsibilities through our executive officers and other advisors, including our legal counsel, our independent registered public accounting firm, our consulting firm for internal controls over financial reporting, and the compensation consultants we have engaged from time to time.

At meetings of the Board, managementManagement makes presentations to the Board regarding our business strategy, operations, financial performance, annual budgets, technology and other matters.

Many of these presentations include information relating to the challenges and risks to our business and the Board and managementManagement actively engage in discussion on these topics. Each of the committees also receives reports from managementManagement regarding matters relevant to the work of that committee. These managementManagement reports are supplemented by information relating to risk from our advisors. Additionally, following committee meetings, the Board receives reports by each committee chair regarding the committee’s considerations and actions. In this way, the Board also receives additional information regarding the risk oversight functions performed by each of these committees.

DIRECTOR COMPENSATIONHedging transactions, by offsetting against the market value of our stock, can reduce exposure to changes in the value of our stock and can thereby reduce alignment with the interests of our shareholders. Under our hedging and pledging policy, as revised in October of 2019, which is included in our Insider Trading Policy, all directors, officers, and employees, including their family members and designees, are prohibited at all times from (i) holding any Company securities in a margin account or pledging Company securities as collateral for a loan; (ii) engaging in transactions in puts, calls, or other derivative transactions relating to the Company's securities; (iii) short-selling securities of the Company; and (iv) purchasing any financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds) that are designed to hedge or offset any decrease in the market value of any equity securities of the Company. The prohibition on hedging does not restrict general portfolio diversification transactions or investments in broad-based index funds.

In

Director Compensation

Beginning in Fiscal 2015,2018 and continuing in Fiscal 2019, the Human Resources Committee engaged an outside compensation consultant, Willis Towers Watson,Semler Brossy to conduct an updated analysis of

analyze the total compensation paid to the Board of Directors (hereinafter, the "2015 Compensation Analysis"). The Consultant was retained byDirectors. Semler Brossy assisted the Committee in reviewing the market data and has not performed any services for Management.made recommendations regarding the types and amounts of compensation the Company pays its non-employee directors. The Committee engagedapproved increases to the Consultant to perform the 2015 Compensation Analysis,non-employee directors' compensation beginning in part, to update a prior analysis prepared by the ConsultantFiscal 2019 and continuing in 2013 (the "2013 Compensation Analysis"). The Committee has the sole authority to retain or terminate any compensation consultant used in the evaluation of compensation packages and has the sole authority to approve the consultant's fees.Fiscal 2020 as described below.

Employee directors receive no additional compensation for serving on the Board or its committees. EachDuring Fiscal 2019, each of our Non-Employee Directors receivesnon-employee directors received an annual retainer of $50,000,$75,000 payable monthly, plusquarterly, a restricted stock unit award valued at $95,000, and reimbursement of expenses incurred in attending Board and committee meetings. The Chairmanmeetings, and, due to their increased responsibilities and duties, the Chair of the Board receivesreceived an additional annual retainer of $40,000, per year, the Audit Committee Chair received an additional annual retainer of $10,000, and the Chairs of the other Board committees also received an additional annual retainer of $5,000. Commencing with the October 2019 restricted stock unit grant, directors will receive an increased equity award of $110,000, a $15,000 increase over the prior year, and the annual retainer for the Chair of the Board and of each committee was increased by $5,000, to $45,000 for the Chair of the Board, $15,000 for the Audit Committee Chair, and $10,000 for the Chairs of the other Board committees.

Effective in October of 2018, all director awards became prospective for the upcoming year. This means that any new directors will receive a prorated award at the next regularly scheduled Board meeting, if the next regularly scheduled Board meeting is not the meeting at which annual awards are granted. Directors who joined prior to this time will receive an award of the annual grant prior to separation of service from the Board.

Director Compensation Table

The following table sets forth the total compensation paid to each non-employee director for Fiscal 2019, other than reimbursement for travel expenses:

|

| | | | | | | | | | |

| Director | Fees Earned or

Paid in Cash(1)(2)

($) | Stock

Awards(3)

($) | All Other

Compensation(4)

($) | Total ($) |

| Maria F. Blase | $ | 71,250 |

| $ | 95,005 |

| $— | $ | 166,255 |

|

| Christopher J. Braun | 75,000 |

| 95,005 |

| — | 170,005 |

|

| Robert M. Chiusano | 106,667 |

| 95,005 |

| — | 201,672 |

|

| William C. Fisher | 80,000 |

| 95,005 |

| — | 175,005 |

|

| David W. Miles | 87,292 |

| 95,005 |

| — | 182,297 |

|

| Richard D. Moss | 85,000 |

| 95,005 |

| — | 180,005 |

|

| John M. Murabito | 80,000 |

| 95,005 |

| — | 175,005 |

|

Martha T. Rodamaker(5) | 21,023 |

| 95,005 |

| — | 116,028 |

|

| |

| (1) | Our directors may elect to receive retainer fees in cash or may defer their retainer fees into the Directors' Deferred Compensation Plan. |

| |

| (2) | The Chair of the Board received an additional $40,000 retainer per year, the Audit Committee Chair receives an additional $10,000 retainer per year, and the Chairs of the other Board committees receive an additional $5,000 retainer per year, each of which are reflected in these figures. |

Committee Chair receives an additional annual retainer of $10,000, payable monthly, due to the Audit Chair's additional responsibilities. The Chairs of the other Board committees also receive an annual retainer of $5,000, payable monthly.

While Mr. Erickson served as Board Chair and Interim CEO, he received no additional compensation over and above his compensation as a director and Chair of the Board.

DIRECTOR COMPENSATION TABLE

During Fiscal 2016 there were no awards of options, stock appreciation rights, or changes in pension value or non-qualified deferred compensation earnings awarded to directors. The Company awarded a restricted stock grant of 6,000 shares on October 13, 2015 to each Non-Employee Director that was on the board at that time. No other stock grants were awarded to directors during Fiscal 2016.

The following table sets forth the total compensation paid to each Non-Employee Director for Fiscal 2016, other than reimbursement for travel expenses:

|

| | | | | | | | | | | | | | | | |

| Director | Fees Earned or Paid in Cash(1) | | Stock Awards(2) | | All Other Compensation(3) | | Total | |

| Irvin E. Aal | $ | 16,168 |

| | $ | 119,100 |

| | $ | — |

| | $ | 135,268 |

| |

| Christopher J. Braun | 35,484 |

| | — |

| | — |

| | 35,484 |

| |

| Robert M. Chiusano | 63,853 |

| | 119,100 |

| | — |

| | 182,953 |

| |

| Jerry N. Currie | 49,000 |

| | 119,100 |

| | — |

| | 168,100 |

| |

| Lawrence A. Erickson | 83,172 |

| | 119,100 |

| | — |

| | 202,272 |

| |

| William C. Fisher | 53,533 |

| | 119,100 |

| | — |

| | 172,633 |

| |

| David W. Miles | 35,484 |

| | — |

| | — |

| | 35,484 |

| |

| Martha T. Rodamaker | 53,533 |

| | 119,100 |

| | — |

| | 172,633 |

| |

| Mark T. Schroepfer | 59,000 |

| | 119,100 |

| | — |

| | 178,100 |

| |

| |